Below is a memo I wrote in January 2024 summarizing my investment thesis for Nextdoor. It is pasted below in its entirety, with slight modifications for clarity. The stock has done well since then, and while I am still a shareholder, it is less actionable for today’s readers. Going forward, I’ll be posting more timely diligence reports and memos.

Summary

Nextdoor is a hyperlocal social networking platform for neighborhoods. At its current valuation of roughly 1x EV / TTM revenue, Nextdoor is a compelling network asset with several tailwinds and asymmetric upside:

Network effects. Nextdoor enables users to create offline-to-online connections, and as a result, it enjoys network effects and rich first-party data. The value of Nextdoor's network increases with each new participant in a virtuous circle: neighborhood adoption creates more activity and content, leading to more engagement and word-of-mouth distribution. 90% of new users join organically—i.e., via word-of-mouth.

Unique advertising asset. Nextdoor has an affluent, economically motivated user base that is untapped by other social media platforms such as Snapchat, Pinterest, and Facebook. 29% of the neighbors who are on Nextdoor don't go to Facebook; 75% do not visit Snapchat; 54% do not visit Pinterest. The lack of overlap with other social media platforms, coupled with the hyperlocal focus, offers avenues for new reach to advertisers.

Several growth vectors. Nextdoor has several avenues for growth:

(1) It is early in building out ads infrastructure and incorporating AI in increasing advertising efficacy and ARPU. Comparable ARPUs from Snapchat and Pinterest suggest greater than 3x ARPU potential.

(2) It can further grow its userbase of verified neighbors (VNs) and weekly active users (WAUs) through continued neighborhood penetration and international expansion. WAU growth has 3x potential with global markets.

(3) There are future opportunities over the next 3-5 years for new kinds of services revenue, such as with social commerce and the sharing economy.

Financially disciplined team. Nextdoor is led by ex-CFO of Square Sarah Friar, and management is committed to sustainable growth, with over 70% of its market cap in cash, opportunistic share buybacks, and a commitment to get to cash flow breakeven by EOY 2025.

One view of equity prices is that they are determined by the interaction between three engines: earnings growth, change in multiples, and changes in shares outstanding. With multiple growth opportunities and a team focused on profitability, low price multiples, and a pristine balance sheet with which to finance future growth investments and share buybacks, Nextdoor is well-positioned with all three engines.

Another view is that they are the sum of discounted cash flows in perpetuity. I discuss the results of a DCF analysis in the Valuation section below.

Valuation scenarios are discussed below, but can range between 2x and 10x, depending on Nextdoor's ability to bring ARPUs in line with comparables and grow its userbase.

Business Overview

Nextdoor is a hyperlocal social networking platform. It connects neighborhood stakeholders, including neighbors, businesses and public services, online and in real life. Users come to the platform to give and get local recommendations, engage in social commerce, discuss local matters, and give and get help. Businesses use the platform for hyperlocal advertising. Public agencies use Nextdoor for emergency alerts, to respond to questions, and for community education. 1 in 3 U.S. and London households are on Nextdoor. In the U.K. broadly, that figure is 1 in 4. Nextdoor is live in 11 countries.

Nextdoor went public in 2021 via SPAC with a Khosla Ventures acquisition vehicle. Since then, its revenue growth has been somewhat lackluster, growing 10% from $192mm to $213mm from 2021 to 2022, and remaining roughly flat in the last year at $216mm. Management attributes the stagnation in revenue to reduced enterprise advertising budgets, especially with home-related spending advertisers (to which Nextdoor has significant exposure).

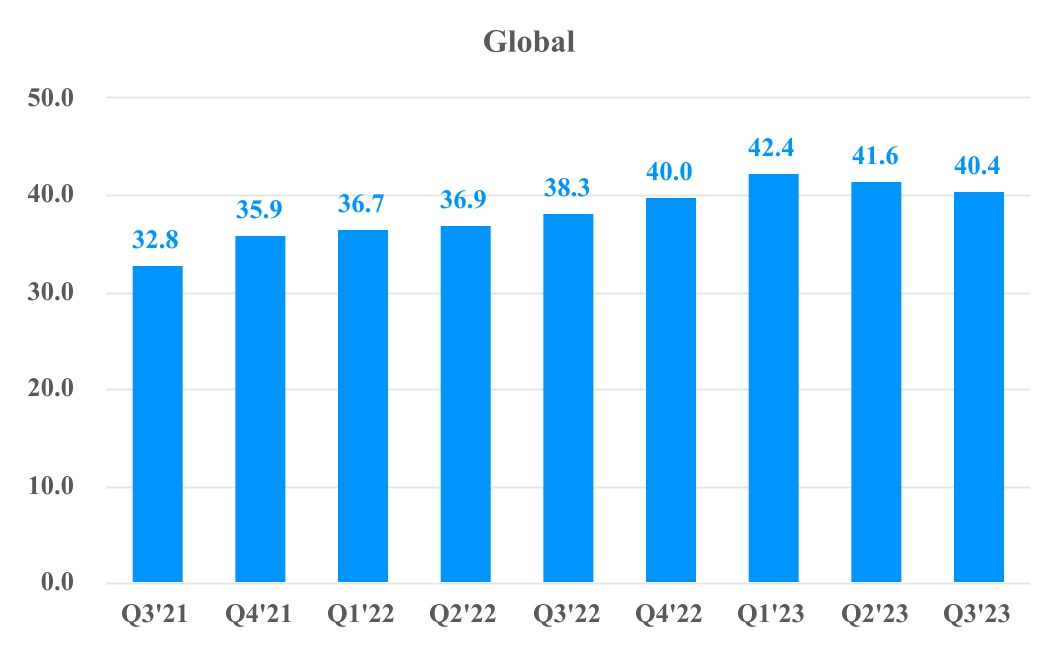

Key business metrics that it tracks include Verified Neighbors (VNs, i.e., users who have joined Nextdoor and completed the verification process for their account), WAUs, and average revenue per (weekly active) user (ARPU). WAUs (40.4 million in the most recent quarter) tend to hover around 50% of verified neighbors (around 85 million). Global quarterly ARPU is around $1.39, and has been as high as $1.65 in recent years. In recent years, ARPU growth has been flat to negative due to challenging macroeconomic headwinds in advertising budgets.

WAU growth has been robust, though with sequential declines for the last two quarters. Management attributes the weakness in WAU growth in the last few quarters to changes to the news feed to improve user perception of the app. They made a conscious decision earlier this year to reduce crime-related notifications, which increased engagement but which creates negative associations with the app.

Financially, Nextdoor has a strong balance sheet with which to finance growth. With over $500mm in cash (70% of its market cap as of this writing) and no debt, Nextdoor is not likely to continue to require dilutive equity financing, protecting investors from share dilution. In fact, management has also been opportunistically buying back shares, and recently expressed a personnel cost reduction goal of $60 million by EOY 2025 to reach cash flow breakeven.

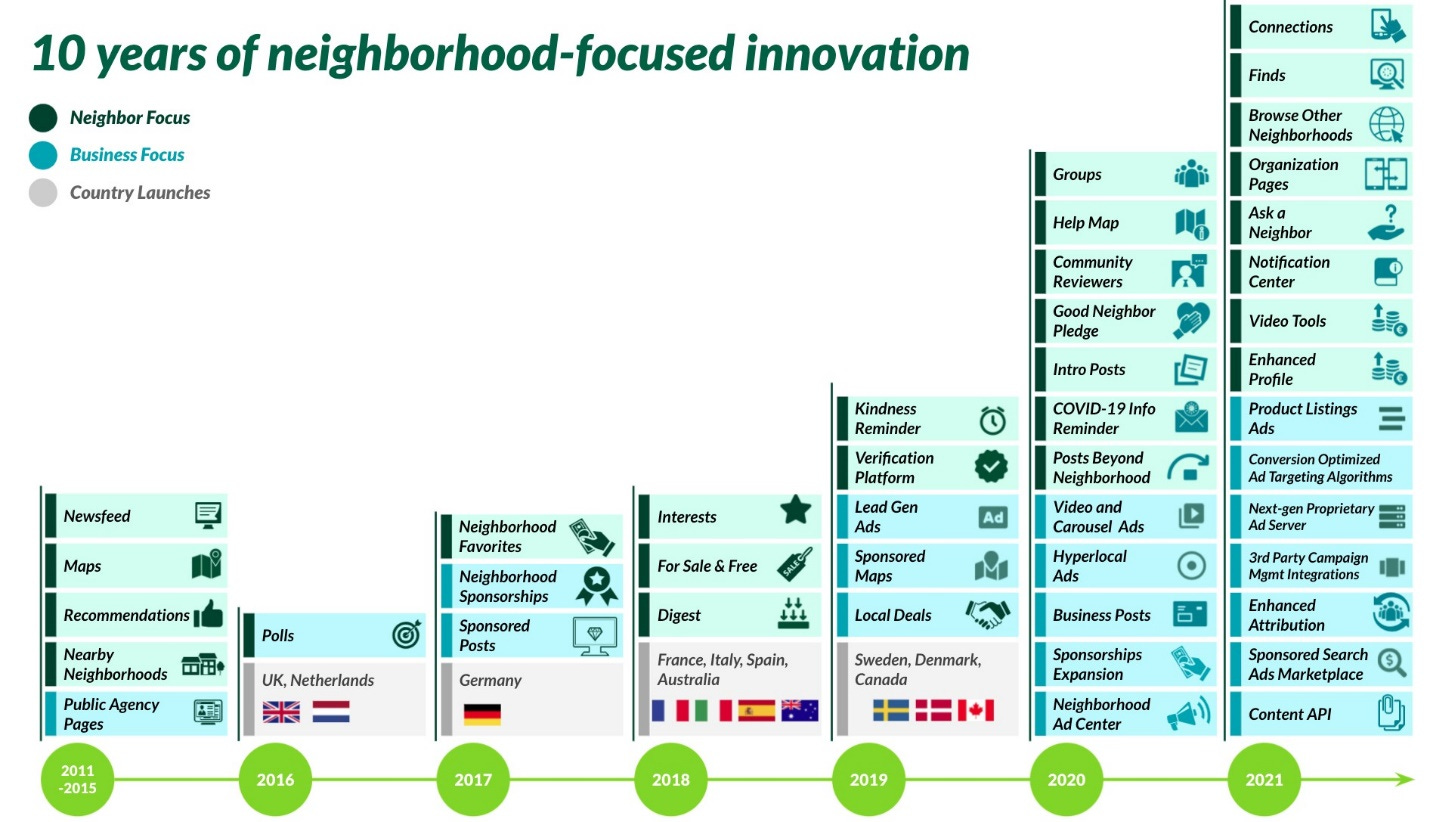

By my estimation, 2022 was a challenging advertiser backdrop that they spent building out product features to increase engagement and retention. Most of the earnings calls in 2022 described product feature improvements, like digital invites, new notification manager, Connections (contacts sync), the Discover tab, the content API, Treat Map, toxicity models, and so on. In 2023, they seemed to focus more on advertising infrastructure; they rolled out and migrated SMB users to the Nextdoor Ads Server and Manager, paving the way for deeper monetization, better ads efficiency, and better gross margins from self-serve ads portals. Concomitantly, they have been trying to diversify across advertiser verticals, from home-related advertisers to healthcare, government, telco, etc.

Growth Prospects & Profitability Outlook

Nextdoor is early along in several growth levers that will significantly enhance revenue over a 3-5 year horizon.

Verified Neighbors and WAUs

Nextdoor can increase WAUs through two means: international expansion and deeper penetration of existing neighborhoods.

On international expansion, only about 20% of VNs are outside of the U.S. Because the platform becomes more valuable and engaging to users as there is more density of usage, I suspect that international penetration is still quite early, and will accelerate as greater density is achieved in new European and English-speaking markets. Particularly in Canada, management notes a great deal of latent advertiser interest, given that there are several U.S. businesses with Canada operations as well.

Deeper penetration of existing neighborhoods is in part a function of product features which make it easier to invite others and which retain users on the platform.

To this end, Nextdoor's local knowledge graph and neighbor-labeled data all contribute to promising first-party data tailwinds that will allow them to surface notifications to users in a more timely manner. "We can use this information to train our ML models and ultimately help neighbors more easily meet their needs on Nextdoor, including finding the most up-to-date local information or exchanging goods and services."

In the latest quarter, they also implemented a "digital invites" feature, which prompts users to invite their contacts or CRM.

They recently released their developer API so that partners can provide and ingest content from Nextdoor, potentially inviting users from off-platform to join.

ARPU

Proprietary data helps serve localized content. Nextdoor recently completed a rollout of Nextdoor Ad Manager, a self-serve ad platform which replaces third-party solutions and enables better utilization of first-party data. Self-serve ads, combined with more conventional infrastructure to manage ad campaigns and pacing and AI that makes it easier for businesses to generate copy, will have the double impact of reducing the cost of servicing advertisers across SMBs, mid-market, and enterprise, as well as to improve the efficacy of ads. With SMBs and mid-market, who are not necessarily professional markerters, self-serve and AI assistants will make it easier to get started and reduce the need for white-glove servicing from Nextdoor; enterprises with sophisticated marketing departments will also prefer to DIY.

Starting in July, 100% of ads from U.S. SMB advertisers were served via our Nextdoor Ad Server, which drove accelerated SMB customer and revenue growth. Our work in Q3 also prepares us to serve substantially all Nextdoor Ads Manager demand on the Nextdoor Ad Server by the end of Q4. Given a subset of midmarket advertisers are already using the Nextdoor Ads Manager, this effectively serves as the first phase of our migration of midmarket customers.

Q3 2023 Earnings Call

Besides generating advertising copy, AI may lead to more user engagement. Today, 70% of LLM-generated suggestions are accepted for content creation (either by businesses or neighbors). Perhaps more importantly, Nextdoor still seems early in the development and deployment of more traditional machine learning and recommendation systems, which should provide an additional lift to user engagement and, downstream, ARPUs. In the third quarter, management mentions having built out "sophisticated pacing methods to better deliver ads over the course of the day", as well as "core components required for performance optimization" so that they can "begin experimenting with this capability later in Q4." The relative nascency of their advertising stack is hopeful for their ability to further optimize and enhance ARPUs.

Finally, international expansion will be a boon both to verified neighbors and WAUs as well as to advertising. Today, around 20% of Nextdoor's verified neighbors are outside the U.S., but only 5% of revenue. As the social network grows in density across international neighborhoods, its value to advertisers also grows. Management notes that "we have a lot of latent interest in advertisers in [international] markets, particularly in Canada, where a lot of businesses in the U.S. have businesses in Canada and know how successful their spend has been here in this market. So we're excited to bring the international platform to their benefit in the next 12 months."

Cost Reductions

I want to make sure that it's clear that we are very focused on expenses in the business and where we are placing incremental investments. So we really have made a big push to make sure that discipline exists through all areas of the company.

- Michael Doyle, CFO, May 2023

Nextdoor management, led by ex-CFO Sarah Friar, is committed to not only growing their top-line of users and ARPU, but also to financial discipline. Besides committing to getting to cash flow breakeven by 2025 (including around ~$60mm of personnel cuts), they have a strong balance sheet of over $500mm cash with which they can continue to invest in their advertising stack and neighbor growth. Even over the last few years, they have kept headcount roughly flat and managed share count with opportunistic buybacks. Finally, as mentioned, the self-serve ad platform will yield margin improvements on ad sales.

Valuation

Method

The value of an equity is a sum of the discounted cash flows in perpetuity. Because Nextdoor does not make significant capital expenditures (and accordingly, has negligible depreciation & amortization) and has no debt, its free cash flows are roughly equivalent to operating cash flows, which is itself roughly equivalent to operating income less taxes.

Accordingly, in order to forecast operating income, I forecast revenue and operating costs, taking into consideration management's stated goal to reduce personnel costs and reach cash flow breakeven by 2025.

In keeping with Nextdoor's self-reported key business metrics, I forecast ARPUs and WAUs, the multiplication of which yields revenue. In total, I model four primary drivers of Nextdoor's equity value:

Verified Neighbors, which represents their ability to grow the top of their user funnel.

WAU to VN ratio, which represents their ability to drive engagement through product experience. This has historically hovered around 50%.

ARPU, which represents their ability to monetize users and sell advertising.

OpEx reductions, which takes into account their cost reduction plans.

Discussion

The valuation is most sensitive to ARPU, and to a lesser extent the number of WAUs. Today, the market is pricing that Nextdoor will never be able to re-accelerate growth in VNs and ARPU.

So it should almost feel like once we're on our own ad platform and able to leverage the data, it's almost like we get the step function in new inventory without having to do anything more than what we've already done. And then you layer on top of that the fact that we are still growing that I just talked about all the investments we're making to grow top-of-funnel, which will accrue to WAU, which will accrue to impressions and sessions. So it does feel like it's a forced multiplication, but it will take another year-ish to kind of finish out the build.

- Sarah Friar, at the Goldman Sachs Communacopia & Technology Conference, Sept 2023.

Snapchat's ARPU (per DAU) is roughly 3x Nextdoor's, and Pinterest is 5x. Supposing that Nextdoor is able to grow ARPU to match Snapchat's and to continue to grow its VNs at a steady clip, its value could increase ninefold. In light of the Nextdoor's buildout of their ad platform and additional opportunities to grow their top-of-funnel, the market's pricing seems too pessimistic.

An argument based on multiples yields results of similar magnitude. With existing cost reduction plans and only conservative assumptions around ARPU improving only slightly, I project that they could grow revenue to $385mm in 2026 and become cash flow positive. If its multiples re-rate to something more in-line with low-growth comparables, I see an upside scenario of around $4 per share.

Risks

Primary risks to the bull thesis include:

Macro concerns in advertising and housing. Much of Nextdoor's advertising is home-related, which makes sense because users tend to join Nextdoor after moving, and tend to be most economically motivated at that point as well. Today, housing affordability is at multi-decade lows. This is somewhat alleviated by (a) Nextdoor's recent efforts to grow relationships with advertising agency partners and to reduce advertiser concentration by diversifying to technology, telecommunications, and healthcare and (b) holding Nextdoor through the business and housing cycle.

WAUs have been flat since Q4 2022. While management attributes this to conscious changes to the app's notifications, it is possible that this belies an underlying deterioration of perception. Many of the top threads in Nextdoor's subreddit poke fun at posts made by the stereotypical caricature of middle American, older white men and women and speculate whether certain posts are fake. Management claims to be working on AI to help moderate toxicity and community sentiment, but it is as of yet unclear how effective these efforts will be. Nextdoor retention rates, while fairly high, represent an uphill battle in retaining monetizable users. After 3 months, 75% of MAUs remain; after 6 months, it drops to 65%; after 2 years, it is 50%.

Nextdoor may not be able to effectively bootstrap neighborhood networks internationally.

ARPUs have remained roughly flat or declined in the last few years. While this might be a function of advertiser budgets more so than the product itself, there is a risk that lower ARPUs may be due to declining engagement or advertising efficiency on the app. However, management mentions that enterprise advertisers are not leaving Nextdoor, only reducing ad spend, and SMBs and mid-market advertisers continue to be strong. This would suggest that once macro improves, spend will recover. Yet even with a recovery, another danger is that there is some fundamental ceiling to how much Nextdoor can monetize its users; e.g., perhaps because people do not spend many hours scrolling Nextdoor the same way they might with Pinterest, Snapchat, and Facebook, it is possible there is simply no way to reach comparable ARPU.

Disclaimer: This memo is for informational purposes only and does not constitute investment advice. The author has a position in the aforementioned security. Readers should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. Investing in the stock market involves risk, including the potential loss of principal.